Startup Valuation – Top 10 Most Valued Startups in India

Regards to all! We are back with another interesting article and it’s abundantly clear by the title that it is about Startup Valuation. Do you know the meaning of Startup Valuation? Have you ever given a thought over how an entrepreneur or a company calculates the worth of their startup? And this brings me to my next question, Do you know the top 10 most valued startups in India? If no, then you are just at the right place because today we will be answering all the above-raised questions. Let’s jump onto the core constituent of our article i.e., Startup Valuation – Top 10 Most Valued Startups in India.

What is Startup Valuation?

In conventional terms, Startup Valuation is the way toward measuring the value of a company, also known as its valuation. Startup valuation, is the value of a startup considering the market influences of the business and the area in which that business takes place.

These factors include the equilibrium (or unevenness) among requests and supply of funds, the size of ongoing events, the readiness of financial backers to pay expenses to put resources into the company.

Why is Startup Valuation Important?

Valuation matters to entrepreneurs, as it decides the share of a company that they need to offer away to an investor in return for cash. The higher the valuation of the company, the less that company needs to provide to an investor in terms of shares and value in return or the cash in an investment they are probably going to get. With a startup, the worth of the company in the start or seed stage will be close to zero.

Later, the valuation of the startup will be higher than that since you need to factor in development potential to investors to leave behind their money. For example, a startup trying to get a ‘seed’ investment will offer 10% of the company for $2 million. This values the company at $2 million. Still that doesn’t really mean it is worth $2 million yet. But in rather broader sense the startup is recommending to the investor that there is a potential for the company to merit that figure after growth and venture.

Now, I hope you are able to understand why startup valuation is important for every company. So, that they could also among the top 10 most valued startups in India.

How is the Valuation of a Startup is Calculated?

Companies are majorly dependent on the assumption for future profits. Valuation is generally about insight and how great an attempt to close the deal the CEO can make.

Some of the important aspects to be considered during the calculation of a company’s actual valuation are mentioned below.

1. The capability of the thought/item.

2. Revenues.

3. Reputation.

4. Foothold in the market.

There are many different methods used in calculating the startup’s valuation other than these key terms. While every one of them varies somehow, but they all are great to utilize. A few of those are mentioned below.

1. SCORECARD VALUATION METHOD

The Scorecard Valuation Method exercises the normal pre-cash valuation of other seed/startup companies around there. And then passes judgment on the startup which needs valuing against them, using a scorecard to get an exact valuation.

Firstly, we find out the average pre-cash valuation of pre-revenue companies in the region and business sector of the target startup.

Then, we find out the pre-cash valuation of pre-revenue companies ,using Scorecard Method and compare. The scorecard is as follows.

1. Strength of the Management Team – 0 to 30 %

2. Size of the chance – 0 to 25 %

3. Item/ Innovation – 0 to 15 %

4. Marketing/ Partnerships – 0 to 10%

5. Additional Investment – 0 to 5%

Finally, we assign a factor to each of the above-mentioned qualities based on the target startup and then multiply the sum of factors by the average pre-cash valuation of pre-revenue companies.

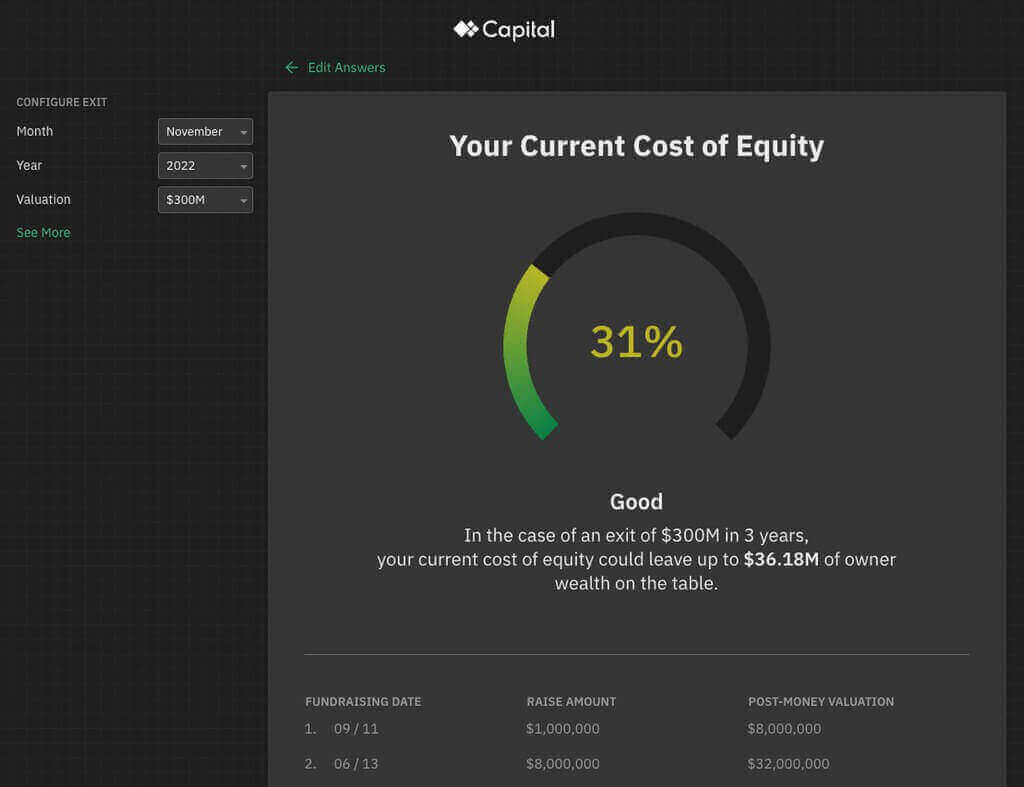

2. VENTURE CAPITAL METHOD

The Venture Capital Method (VCM) is one of the strategies for showing the pre-cash valuation of pre-revenue businesses. The idea was first portrayed by Sir Bill Sahlman at Harvard Business School in 1987. It follows the formula mentioned below.

Return on Investment (ROI) = Terminal value / Post money valuation

Then, Post money Valuation = Terminal value /Anticipated ROI

Terminal value is the startup’s anticipated selling cost in the future, estimated by utilizing reasonable assumptions for revenues in the year of sale and assessing profit.

3. BERKUS METHOD

The Berkus Method allocates a number, a financial valuation to every one of four significant components of risk faced by every young startup – after crediting the entrepreneur some essential value for the quality and potential of the idea itself.

This method represents a part of the main risk factors for checking the crates on everyone and attempts to give a matter-of-fact self-assertive worth in return.

A user of this model can refine it by changing the sum added in all cases to reflect higher or lower prevailing market valuations. For example, have the elements amount to something other than what’s expected than $2.9M.

However! In general, It is a little rough, moderately simple, and to some degree misrepresented model.

4. COST-TO-DUPLICATE METHOD

This procedure includes looking at the hard assets of a startup and calculating the amount it would cost to imitate a similar new company elsewhere.

The thought is that an investor wouldn’t contribute more than it would cost to duplicate the business. The huge issue with this method is that it does exclude the future potential of the startup or elusive resources like brand worth, notoriety, or hotness of the market.

In light of this, the money to-copy technique is frequently utilized as a ‘lowball’ gauge of organization esteem.

5. DISCOUNTED CASH FLOW (DCF) METHOD

This method includes predicting how much income the company will produce and afterward calculating how much that income is worth against an excepted rate of investment return.

A higher discount rate is then applied to new companies to show the high risk that the company will fail, as it’s simply beginning.

This technique depends on the market examiner’s ability to make great assumptions about long-term development. For few new businesses, it turns into a speculating game.

Top 10 Most Valued Startups in India

Well, now you have an idea of how to calculate a startup’s valuation. If yes, here are the top 10 most valued startups in India.

- Reliance Industries

- HDFC Bank

- Hindustan Unilever Ltd.(HUL)

- ICICI Bank

- Tata Consultancy Services (TCS)

- Bajaj Finance

- Axis Bank

- State bank of India (SBI)

- Ola Cabs

- OYO Rooms

Key Takeaways

Well, these are the top 10 most valued startups in India mentioned above. Yes, Valuation is mostly about guess and predictions. But this is the best way to find out the genuine worth of your startup before others settle on what’s worth. So, make your decision wisely.

I hope you love my content on “Startup Valuation – Top 10 Most Valued Startups in India”. And if you find it insightful, then please offer us feedback.

For more article, you can refer to the links given below.

Top SaaS Startup | Successful SaaS Startups in India 2021

Apps for Entrepreneurs | Best Apps for Entrepreneurs 2021 You Must Know

Awesome!!!!